The Ad Council and the U.S. Department of the Treasury is having a Twitter Chat on June 9 at 1pm EST for Homeownership Preservation Month. Foreclosures can have a devastating effect on families and communities. While there are signs that the country and the housing market are recovering from this most recent financial crisis, there are still too many homeowners struggling to make their mortgage payments or facing the prospect of losing their homes. About one in 13 homeowners nationwide has fallen behind on his or her mortgage payments, putting them at a higher risk of foreclosure. Homeowners should not feel alone, but many do.

That is why the Making Home Affordable (MHA) program provides free resources and assistance for distressed homeowners who are working hard at juggling expenses to makes ends meet. There are more options available for struggling homeowners today than ever before, and MHA works to provide them with the mortgage solution that is right for them.

Across the country, more than 1.5 million families have already been helped through MHA programs. Through the Home Affordable Modification Program (HAMP) alone, many homeowners are able to reduce their monthly mortgage payments by approximately $500 each month. That’s real payment relief.

June marks Homeownership Preservation Month. There is help for those who may be having a tough time making their mortgage payments and don’t know where to turn. Here’s how you can get help and find out more:

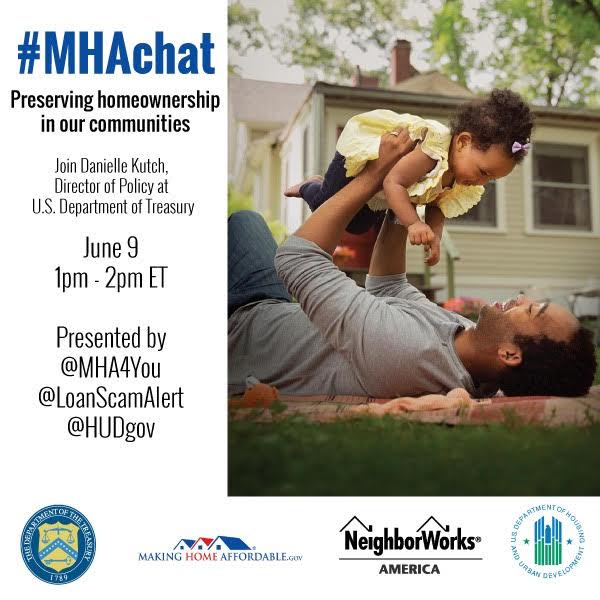

- Please join the #MHAchat to learn more about preserving homeownership in our communities. Experts from the U.S. Department of Treasury Homeownership Preservation Office, HUD, and NeighborWorks America will be available to answer questions.

- Hashtag: #MHAchat

- Date: June 9 from 1-2pm ET

- Hosts: @MHA4You, @HUDgov, @Loanscamalert

Through the Federal Making Home Affordable program, many homeowners have received much-needed help to reduce their monthly payments, get mortgage relief, and avoid foreclosure. Homeowners who are struggling to make mortgage payments can call 888-995-HOPE or visit MakingHomeAffordable.gov for free resources and information to help them with their mortgage problems and avoid foreclosure. By calling the hotline, homeowners can speak with a housing expert at a HUD-approved counseling agency at no cost, 24 hours a day, 7 days a week and identify potential solutions based on their individual circumstances.

(I donated this post as part of a social good campaign and did not receive compensation for doing so.)

2014

2014